Public, Non-Traded Real Estate Investment Trust Opportunity

Seasons of Life

Who is Aquinas Senior Living?

- Founded by a core group of real estate experts that have been involved in the commercial real estate industry for more than 35 years with experience in all aspects project lifecycles including: locational analysis, development, financing, acquisition, marketing, management, leasing and investment property sales.

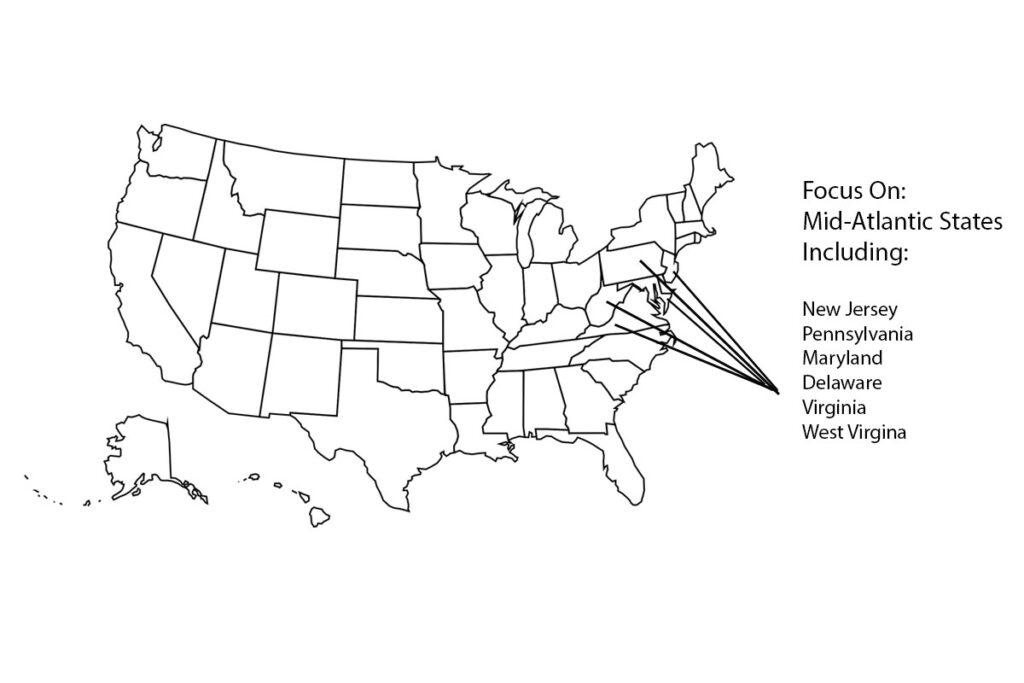

- Focused on acquiring, renovating, developing and managing investment real estate in the senior housing sector. Initial focus will be in the Mid-Atlantic States.

- The senior management team of Aquinas Senor Living, (“ASL,”) has demonstrable experience spanning four decades and a proven track record in the commercial real estate sector with private, public, non-profit and for-profit companies.

What is Aquinas Senior Living?

- A unique, balanced investment vehicle solely focused on acquiring senior property, including active adult, independent living, assisted living and memory care properties considered “Value-Add,” while simultaneously cultivating a pipeline of ground up development via affiliated entities.

- The two prong approach affords ASL the opportunity to grow a portfolio of senior living assets with consistent and stable current income while simultaneously adding value from newly developed assets in a segment of the commercial real estate market that has excellent growth prospects.

- The Trust is a Maryland entity and is structured as a private, non-traded real estate investment trust (“REIT”).

- ASL will be externally managed by its founding executive team.

Why Aquinas Senior Living?

- Diversified strategy within the senior housing sector that balances current income and growth.

- After air, water, and food, we all need shelter. ASL will acquire, manage and optimize a diversified portfolio consisting of income generating value-add senior housing while simultaneously cultivating a development pipeline to capture growth from very favorable demographic trends – an aging population.

- Why Senior Housing? Demographics are clear; Americans 65 years and older are increasing and now comprise 15.6% of the population. Many are choosing to sell their homes, and rent instead. Additionally, the 85 year and older cohort will grow from roughly 5.8 to 19 million people by 2050.

- ASL will focus on delivering competitive, risk-adjusted current, tax sheltered returns, via quarterly dividend distributions and manage the portfolio to yield attractive total annual returns.

Market Overview

The geographic area that the business will focus on is known as the Mid-Atlantic region of the country, an area roughly 121,000 square miles that includes the states of; New Jersey; Pennsylvania; Delaware; Maryland; Virginia; West Virginia and the District of Columbia, (Washington, D.C.). This region is home to 54 of the 100 highest-income counties in the nation, based on median household income, and 43 of the 100 based on per capita income. Additionally, the individual Mid-Atlantic States consistently rank among the top states in the nation. This Region includes parts of the 2nd, 3rd, and 4th Federal Reserve Banking Districts. More detailed economic data can be obtained from the Federal Reserve Bank Beige Books produced by each of those Banking Districts.

The value of investment real estate property in the Mid-Atlantic is incalculable primarily because it includes three of the top ten MSA in the County: New York, Philadelphia and Washington, DC, and because market prices are in a constant state of flux; however, a value in excess of US$1.2 trillion dollars is very conservative. Equally as important, are both the number of people living in this region and the annual GDP produced. According to the 2016 census estimate, as reported by the St. Louis Fed, 53.9 million people (18% of the total US population) called this region home and they produced total GDP of $3.9 trillion (18.7% of the national total) that year.

The region is home to numerous institutions of higher education, top hospitals and medical research facilities. It enjoys modest year-over-year population growth. The Census Bureau reports nationwide first quarter 2018 homeownership stands at 64.2%, which has trended downward from a high of 69.2% in 2004. Factors at work here include: an aging population seeking to downsize their residence and move into nearby cities and suburbia; delayed first home purchases by millennials and economic hardships caused by the Great Recession and COVID. Those reasons, plus and aging population, bode well for continued growth of the senior housing market especially in the Mid-Atlantic.

The REIT will operate in the Mid-Atlantic region focusing on Value-Add senior housing real estate acquisitions and development opportunities in predominantly three levels of acuity that include independent, assisted living and memory care.

Investment Opportunity

Investment Objectives

Capital Preservation

Investments in hard assets, maintained improved and managed by experts.

Competitive Annual Returns

Dividends paid quarterly plus annual stock appreciation as assets are purchased and improvements are completed.

Non-cyclicality

Income streams from this asset class are historically not correlated to the stock market.

Capital Appreciation

Combination of annual dividends, growth of principal as mortgages amortize, plus annual property appreciation.

Tax Advantaged

Dividends qualify for the 20% deduction on pass-through income, as a result of the 2018 JOBS Act, for a short period longer.

Leadership Team

Leonard S. Poncia

Chairman of the Board, Chief Development Officer

- Chief Development Officer and Senior Executive of Aquinas Senior Living

- 35 + years in all aspects of commercial real estate sales and development.

- Experienced developer of housing, low and high rise apartment buildings, urban infill office, retail and industrial investment property.

- Entitlement process expert at federal, state and municipal levels.

- Development and sales activities exceed $2 billion.

Stephen J. Schmid

President, Chief Executive Officer

- Co-Founder of Aquinas Senior Living.

- 35 + years in all aspects of real estate investment property sales, finance and capital raising. Experienced in underwriting and valuing all major real estate property types.

- Public and private company experience responsible for equity capital raising, debt financing, joint venture development project finance and construction lending with NASDAQ, NYSE and family office companies.

- Sales and finance activities exceed $500,000,000.

Jim Burnham

President Management Services, Chief Operating Officer

- Experienced and resourceful C-suite executive in the senior housing and long-term care industry in the for-profit and notfor- profit landscape since 2000.

- Engaged to provide subject matter expert testimony for proposed senior housing and care projects in excess of $500,000,000.

- For-profit, non-profit, CCRC and Affordable Housing development projects in DE, FL, and PA.

- Most recently, President of Lancaster, PA based senior housing company with over 225 employees with multi-site operations.

- Cycle test through the uncharted waters of the COVID-19 pandemic managing total revenues exceeding $45M.

Michael T. Hines

Executive Vice President, Strategic Finance

- Co-Founder of Aquinas Senior Living.

- Corporate finance executive with three decades of transactional experience. Managed public offerings, private placements, mergers and acquisitions. Syndicated equity placements to Banks, Institutional Investors, Family Offices and Wealth Managers domestically and internationally.

- Capital market funding activity in excess of $500,000,000.

Benjamin J. Myers

Executive Vice President, Business Development

- Senior Executive of Aquinas Realty Trust.

- 15+ years in the real estate acquisition, development and construction industries in project management, strategic and ownership roles including ownership of an assisted living portfolio.

- Experienced at sourcing, executing and managing deal opportunities.

- Masters degree in Real Estate Development.

J. Preston Eberly

Senior Vice President, Business Development

- Senior Executive of Aquinas Realty Trust.

- 10+ years in real estate acquisition, management, financing, investor relations.

- Experienced in managing large RE portfolios, sourcing off-market deals, and maintaining banking relationships.

- Licensed Realtor in the state of PA.

- Development and Investment activities exceed $25 Million.

Brian T. Myers

Senior Vice President, Director of Resident Life

- Senior Executive of Aquinas Realty Trust.

- 20 years in real estate acquisition, management, financing, investor relations.

- Experienced in raising capital as well as acquiring, managing, and selling multifamily, office, industrial and mixed-use real estate.

- Development and Investment activities exceed $25 Million.

Benjamin H. Bamford

Senior Vice President, New Project Development

- Senior Executive of Aquinas Realty Trust.

- 30+ years of Real Estate development and entitlement with in-depth knowledge multifamily, hotel, retail, healthcare, life science and low-income housing tax credit projects. Ben has been the chairman of the Lancaster Industrial Development Authority since 1996 and is vice chairman of the Lancaster Municipal Authority.

- Licensed Real Estate Agent in Pennsylvania.

David C. Bosak

Senior Vice President, Strategic Initiatives

- Senior Executive of Aquinas Realty Trust.

- 25+ years of professional experience in the real estate acquisition, development, and commercial construction industries. Responsibilities have included procurement of existing multifamily and senior living communities as well as identification and procurement of land and entitlement ground up opportunities related to both.

- Seasoned C-level strategic business development expert specializing in off-market opportunity identification and acquisition. Experienced development principal as well as investor liaison between project stakeholders and governmental entities across the mid-Atlantic.

- Commercial real estate acquisition, construction, and development activities currently exceed $800 million in contracted value.